A program built for security now faces a future of automatic cuts

August 14th marks the 90th birthday of Social Security, one of the most successful and popular government programs in U.S. history. For nine decades, it has provided a financial foundation for tens of millions of retirees.

But now, the program faces its most predictable crisis yet.

Social Security’s trust fund is on track to go insolvent within a decade. When that happens, all 70 million recipients will see an automatic 24% cut in benefits. Millions of seniors will be pushed into poverty overnight.

Refusing to make changes to Social Security’s revenues or benefits is the equivalent of voting for a 24% cut across the board.

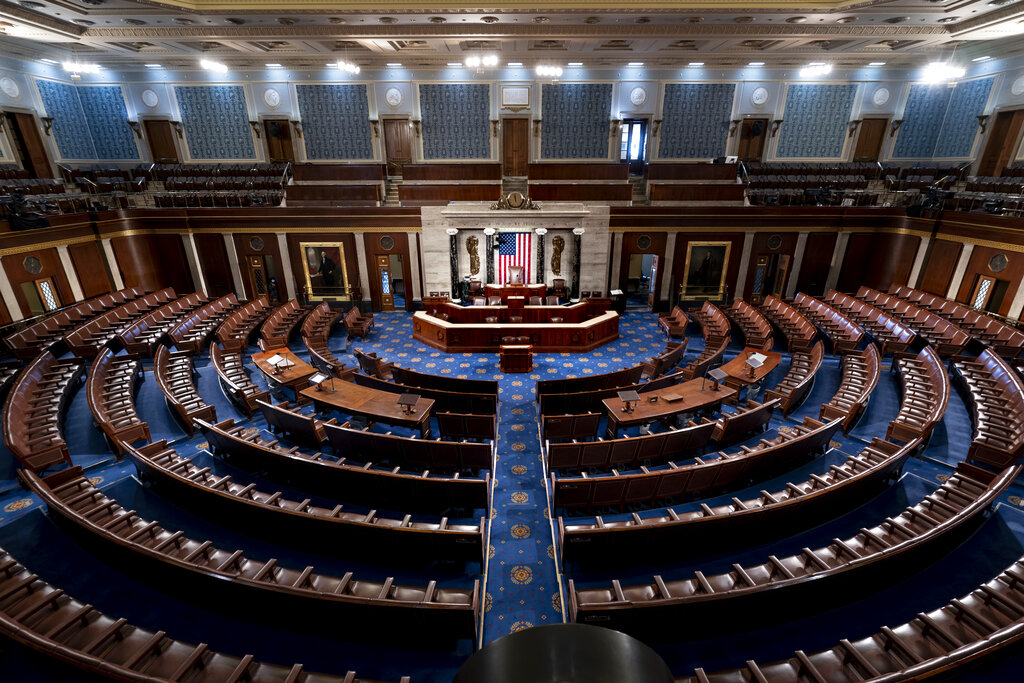

And yet no party leader in Washington is willing to act.

Presidents Trump and Biden, Senate and House leaders in both parties – all have promised not to change Social Security (or allow it to be changed).

This is the classic case of kicking the can down the road. But the longer Washington waits, the harder and costlier it will be to fix Social Security.

Social Security is popular for a reason. According to polls by the AARP, 96% of Americans consider it important, and two-thirds of retirees rely heavily on it.

And history shows that fixes are possible – in 1983, President Ronald Reagan and Democratic Speaker Tip O’Neill worked together to secure decades of solvency through a mix of payroll tax changes and benefit adjustments.

Today, there are plenty of bold, bipartisan proposals – like Senator Bill Cassidy’s “Big Idea” – to save Social Security. The only thing that’s missing is political courage from party leaders.

Related

Peyton Lofton

Peyton Lofton is Senior Policy Analyst at No Labels and has spent his career writing for the common sense majority. His work has appeared in the Washington Examiner, RealClearPolicy, and the South Florida Sun Sentinel. Peyton holds a degree in political science from Tulane University.

You must be logged in to post a comment.